The Digital Euro and Sensitive Payments

A critical analysis of privacy, regulation, and payment processor influence in the EU's CBDC initiative

Executive Summary

Key Finding

The EU Digital Euro project, with its emphasis on privacy and user control, potentially offers a more reliable payment alternative for sensitive transactions, including those for adult content. However, it is unlikely to completely solve issues like "definitional creep" or payment processor influence, as Payment Service Providers (PSPs) will still handle onboarding and compliance.

The digital euro's success in addressing sensitive payments will depend on its final design, the regulatory environment for PSPs, and its ability to provide a genuinely neutral payment rail that reduces reliance on private payment processors whose policies often drive financial censorship.

Technical Design and Privacy Features

Privacy by Design Foundation

The European Central Bank has emphasized that privacy is a cornerstone of the digital euro's design, aiming to offer the highest privacy standards among electronic payment options. This commitment stems from public demand, with 43% of respondents in public consultation prioritizing privacy and data protection.

Key Privacy Technologies:

- Pseudonymisation: Replacing identifiable information with random unique identifiers

- Data Encryption: State-of-the-art encryption for data in transit and at rest

- Hashing Techniques: Protecting transaction data from direct linkage

Tiered Privacy Approach

Offline Functionality: Cash-Like Privacy

A significant privacy-enhancing feature is the planned offline functionality, designed to offer privacy comparable to cash transactions. This would allow users to make payments without an internet connection, with transaction details known only to the payer and payee.

Key Benefit for Sensitive Transactions:

Offline transactions would not be shared with payment service providers, the Eurosystem, or any supporting service providers, mirroring the anonymity of physical cash exchanges.

Offline Transaction Limits

Potential for Sensitive Transactions

The digital euro, particularly with offline functionality, holds potential to offer a more reliable payment alternative for legally permissible but sensitive activities, including adult content creation and distribution.

- Reduced risk of deplatforming

- Mitigated financial censorship

- Enhanced privacy protection

Critical Success Factors

- • Final design of privacy features

- • PSP obligations and interpretations

- • Widespread acceptance and ease of use

- • Balance between privacy and AML/CFT requirements

Regulatory Framework and Legal Aspects

EU Fundamental Rights

Privacy and data protection are enshrined as fundamental rights in the EU Charter (Articles 7 and 8), forming the foundation for digital euro design.

AML/CFT Compliance

Must balance privacy with Anti-Money Laundering and Counter-Terrorism Financing regulations, requiring PSP oversight.

Legal Tender Status

Proposed as legal tender for online payments, ensuring widespread acceptance within the euro area.

Digital Services Act (DSA) Implications

The DSA creates significant implications for online platforms, including those hosting adult content. Very Large Online Platforms (VLOPs) like Pornhub, Stripchat, and XVideos face stricter obligations.

Key DSA Requirements for VLOPs:

- • Robust age verification systems

- • Risk assessments for illegal content

- • Protection of minors

- • Transparency reporting

Non-compliance risks fines up to 6% of global annual turnover, creating significant pressure on platforms to implement stringent controls.

Financial Inclusion Objectives

The digital euro aims to ensure financial inclusion, making it accessible to all segments of the population, including those vulnerable to digital financial exclusion.

- Basic services provided for free

- Offline functionality for areas with poor connectivity

- Support for unbanked individuals

- Face-to-face assistance via post offices

Target Demographics

- • Individuals with disabilities

- • Elderly population

- • Those with limited digital skills

- • People without fixed address

- • Asylum seekers and refugees

Current Payment Processor Influence

Understanding "Definitional Creep"

Mechanisms of Control

- Visa/Mastercard Policies: Set global standards for acceptable content

- High-Risk Classification: Adult content labeled MCC 5764 with stricter scrutiny

- Service Withdrawal: Threat of losing payment processing capabilities

Case Study: Steam's Adult Content Policies

Steam updated its adult content policies in response to pressure from payment processors like Visa and Mastercard, who threatened to withdraw payment services if the platform didn't comply with their content standards.

Valve's Statement:

"Certain games were retired because they may violate the rules and standards set forth by our payment processors and their related card networks and banks."

Impact on Developers:

- • Vague guidelines creating uncertainty

- • Games with themes like incest targeted for removal

- • Chilling effect on creative expression

- • De facto censorship without public accountability

The Power Dynamic

Corporate Censorship Concerns

Current Problems

- • Private companies setting moral standards

- • Lack of transparency in policy enforcement

- • Arbitrary content restrictions

- • No democratic accountability

- • Chilling effect on legal expression

Consequences

- • Financial exclusion of legal businesses

- • Reduced diversity of sexual expression

- • Impact on livelihoods of sex workers

- • Limited consumer choice

- • Corporate control over culture

Addressing Specific Issues

Digital Euro as Alternative Infrastructure

Potential Benefits

- Public Governance: Operates under democratic oversight rather than corporate profit motives

- Enhanced Privacy: Reduced data tracking compared to commercial payment solutions

- Legal Tender Status: Reduced ability for arbitrary service denial

- European Sovereignty: Reduced dependence on foreign payment systems

Limitations & Uncertainties

- PSP Gatekeeping: Payment Service Providers still control access and onboarding

- AML/CFT Requirements: PSPs must still perform compliance checks

- Transaction Limits: Privacy features may have restrictive thresholds

- DSA Compliance: Platform-level obligations remain unaffected

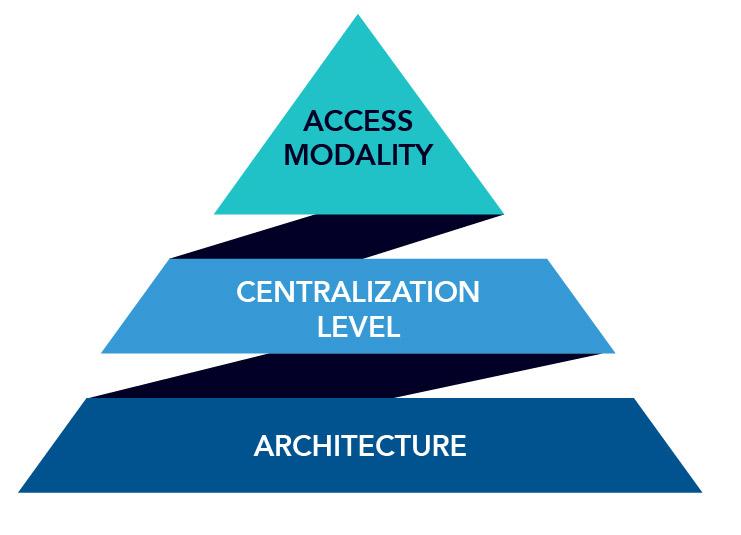

Payment Service Provider (PSP) Role Analysis

User Onboarding

KYC/AML checks, account creation, identity verification

Transaction Processing

Payment initiation, transaction monitoring, compliance

User Support

Customer service, dispute resolution, technical support

Critical Concern:

PSPs remain gatekeepers to the digital euro system. If they adopt overly restrictive interpretations of AML/CFT duties or apply discriminatory terms of service, the privacy benefits at the Eurosystem level could be undermined at the point of user access.

Mitigation Potential Assessment

Factors Enhancing Mitigation

- Public governance reduces corporate censorship motives

- Offline functionality provides cash-like privacy

- European sovereignty reduces foreign processor influence

- Legal tender status provides payment certainty

Factors Limiting Mitigation

- PSPs still control access and compliance

- AML/CFT requirements necessitate oversight

- DSA obligations affect platforms regardless of payment method

- Transaction limits may be too restrictive for practical use

Conclusion

Positive Developments

- • Enhanced privacy through offline functionality

- • Reduced corporate censorship motives

- • European sovereignty in payments

- • Legal tender status protection

- • Financial inclusion objectives

Persistent Challenges

- • PSP gatekeeping remains

- • AML/CFT compliance requirements

- • DSA platform obligations

- • Transaction limit constraints

- • Definitional creep may continue

Final Assessment

The EU Digital Euro project offers meaningful improvements in payment privacy and represents a significant step toward reducing reliance on foreign payment processors. Its offline functionality and privacy-by-design approach could provide a more reliable alternative for sensitive transactions.

However, the continued role of Payment Service Providers as gatekeepers, combined with existing regulatory frameworks like the DSA and AML/CFT requirements, means that the digital euro is unlikely to completely eliminate issues like "definitional creep" or payment processor influence. Success will depend on careful implementation, robust oversight of PSPs, and ongoing commitment to privacy preservation.